Data Capture Software on the Central Coast

Get Started Today

Thank you for contacting Books in a Mess Australia.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

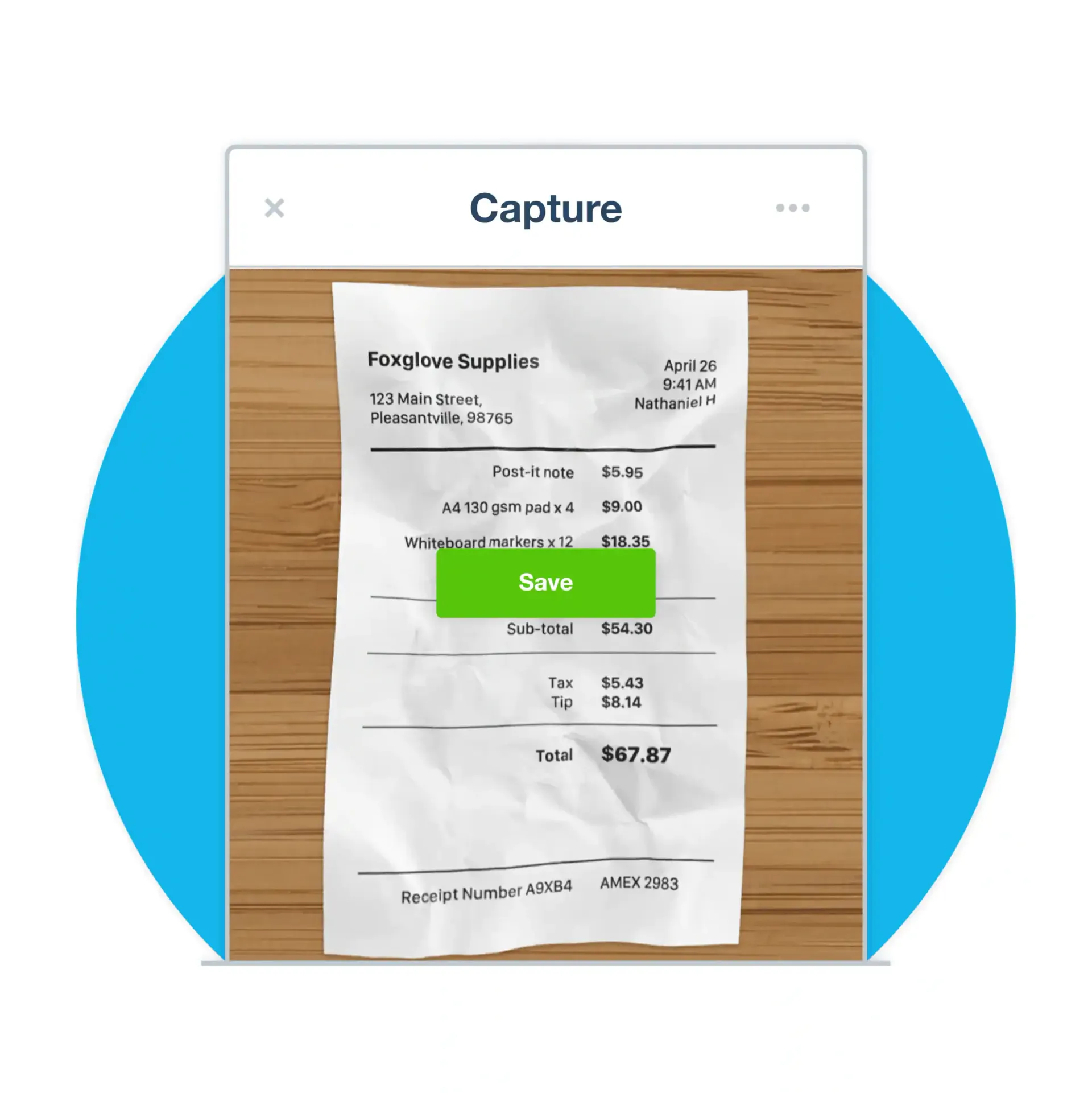

Streamlined Data Capture for Accurate Records

At Books in a Mess Australia, based on the Central Coast, we use data capture software to simplify the process of recording and managing financial information. Our systems, including Xero and DEXT, allow businesses to digitise receipts, invoices, and other financial documents for secure storage and efficient processing. By integrating these tools into everyday operations, we reduce the need for manual data entry while maintaining accuracy and compliance with Australian bookkeeping and taxation standards.

Each document is scanned, coded, and stored automatically, creating a clear record that can be retrieved at any time. This process improves organisation and ensures that financial data is available for reporting, auditing, or BAS preparation whenever required. We apply structured workflows that meet the needs of businesses looking to transition toward paperless financial management.

We focus on creating efficient, transparent systems that help businesses manage their financial data safely and accurately. To learn more about how data capture software can support your operations, call 0407 535 880 today.

Frequently Asked Questions

What is data capture software and how does it work?

Data capture software converts paper or digital financial documents — such as receipts, invoices, and statements — into structured, readable data that can be stored electronically. The system uses optical character recognition (OCR) and machine learning to extract key information like dates, supplier names, amounts, and tax details. This data is then categorised and synced with accounting software such as Xero, QuickBooks Online, or MYOB. Once uploaded, records can be searched, filtered, and retrieved instantly, eliminating manual data entry and reducing the risk of duplication. Data capture software is now a key component of modern bookkeeping and financial management systems.

How does data capture software improve bookkeeping accuracy?

By automating the entry of receipts and invoices, data capture software reduces the likelihood of manual input errors. Systems like DEXT and Hubdoc are designed to read information directly from images or PDFs, ensuring the data transferred to accounting software is precise and consistent. The use of automated matching also ensures that every transaction in the accounting system corresponds with an actual document, creating a clear audit trail. This process improves transparency, reduces discrepancies in financial reporting, and allows for faster reconciliations. When combined with proper oversight, data capture tools significantly enhance the reliability of bookkeeping records.

Is data capture software secure for financial information?

Modern data capture software uses encryption, multi-factor authentication, and cloud-based storage to protect financial information. Files are stored on secure servers that comply with international data protection standards such as ISO 27001. Access controls allow only authorised users to view, edit, or download data, and all activity within the system is logged for traceability. In Australia, businesses must also ensure that their digital record storage meets ATO and Privacy Act requirements. Cloud-based systems like Xero and DEXT are compliant with these standards, offering a secure and efficient way to store and access business records without relying on physical filing systems.

How We Use Xero & DEXT

We use Xero and DEXT to capture, classify, and store financial documents securely in real time. These platforms allow users to upload invoices and receipts through mobile devices or email, where they are processed automatically using optical character recognition (OCR) technology. Once entered, each record is categorised and matched with the relevant transaction in Xero, maintaining consistency across all accounts.

Our systems are configured to ensure every transaction is linked to valid documentation, reducing the potential for human error and improving audit traceability. By managing data in the cloud, we also improve accessibility — authorised users can review, share, or verify documents from any location with an internet connection.

This method not only supports accuracy but also ensures compliance with Australian record-keeping laws, which require businesses to retain clear and accessible financial data. We maintain structured procedures for reviewing, updating, and backing up information to ensure each client’s records remain accurate and secure.